What is GAP?

Guaranteed Auto Protection (GAP) has been created to provide loan payoffs in the event the vehicle is totaled or is a non-recovered theft. The GAP waiver relieves the borrower and the lender of the responsibility for the remainder of the loan balance that the proceeds from the primary insurance policy or any applicable third party insurance policy does not cover.

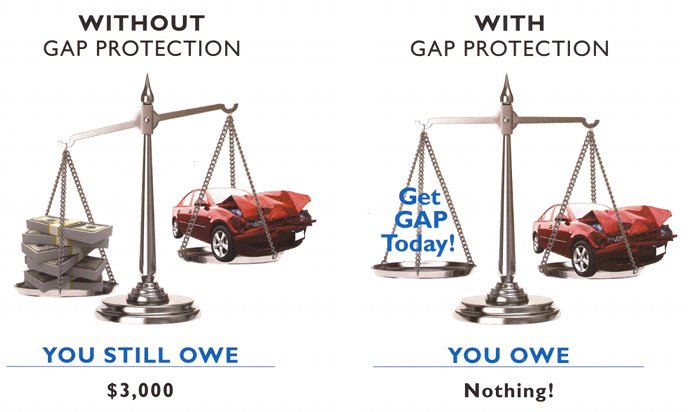

Example:

- Borrower purchases a vehicle for $25,000, after one year the balance of the vehicle loan is $21,000.

- The vehicle is totaled in an accident and the primary insurance company pays the “actual cash value” of the vehicle, which comes to $18,000.

- That leaves a gap of $3,000 that the borrower is responsible to pay to the lender.

- GAP Coverage pays the remaining balance, leaving the borrower NO DEBT to the lender.

Advantages of Resource Insurance Services GAP:

• Coverage up to 150% of the value of the vehicle, MSRP on new vehicles, and NADA retail on used vehicles

• Coverage for loans/leases up to 84 months

• Covers to $1000 of the primary insurance company’s deductible

• GAP coverage can be added ANYTIME, not just at loan inception

• Full-time trainer to perform all training at your institution. The staff will be taught to fully understand GAP and find opportunities to present and cross-sell GAP to borrowers at times other than simply at initial loan closing

• We provide you a local agent presence to assist in training, marketing and problem solving issues, including claims.

• GAP claims can be submitted online via the Internet to expedite GAP claims.

• A vast array of marketing materials will be provided including framed posters, desktop sales mats, brochures, statement stuffers, and letters to name a few, specifically designed to hit your borrowers needs.

• Monthly administration of the GAP program is simple and efficient utilizing our Internet based software program.